8/ديسمبر(سهم واحد) وله تقرير

1) vert

الشراء بين 1.50 الى2

الخطوره 1.30

البيع3 الى 3.50

السهم له تقرير مفصل وجميل ولكن اختصر في كلمتين

24 نوفمبر تمت مبايعة لاسهمها بسعر 1.10 الشركة نمت بشكل افضل من السنه المالية الماضيه وارباحها نمت بشكل جيد 3 مرات عن السنه الماضيه

والعملا ايضا 600%

الشراء واضح جدا من قبل المدراء والانسايدر السعر المتوقع والذي تصل له ان شاء الله خلال اسابيع قليلة 3 الى 3.5

الشركة تقدم حلول ادارية لكثير من الشركات 2000 شركة

يصف ان سعر السهم اصبح في السترونق هان اليد القويه وليس في اليد المتردده

وهذا تقريرvert

Stocks to watch:

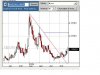

VERT - it's hard to ignore the bullish near term technical signals now being exhibited by Verticalnet Inc (VERT). Shares of Verticalnet rose nearly 36% in an overwhelmingly negative market environment to close near their high of the session at $1.74 on very heavy trading volume (nearly 7 million shares traded hands versus the stock's 90 day average daily volume of just over 226k shares per day). No news out that we can see to affect such a change, so we have to assume it was purely technical in nature. Still, it was a very healthy technical development that from a chart price pattern perspective clearly signaled an upside breakout for a stock that was recovering from a 52 week low (set back in mid August) around the $1.00 area and one that was well off of its 52 week high it reached in late January of this year around the $3.70 area. If buying interest in this stock continues to mount, a return to the $3.00 to $3.50 area is quite possible over the next few weeks.

Verticalnet, Inc. is a provider of supply management solutions to Global 2000 companies. The Company provides supply management software, services and domain expertise in areas that include spend analysis, advanced esourcing, eprocurement, contract management and supplier scorecards. Its solutions are bundled into four process steps of supply management: Supply Strategy, Supply Selection, Supply Execution and Supply Performance. In addition, Verticalnet's professional services and consulting groups provide customers with project management, architecture and design, custom development services and training.

As most of you who've been with A-Z for some time may have figured out by now, we love to see major divergences in our technical analysis of a stock - and boy do we have a dilly with our technical assessment of VERT. Money flow into this stock is now at a nearly four year high. In fact, the last time accumulation in this stock was this high shares of Verticalnet were trading between $50 and $60 per share. This year alone as the stock continued to fall from its 52 week perch in the $3.70 area to near the $1.00 area over the first eight months of the year, money flow remained constant (after a limited drop from late January to early April after which it slowly began stairstepping higher once again). This suggests that the stock was moving from weak hands to strong hands. Yesterday's close of $1.74 put the stock's price well above the high end of our set Bollinger Band parameters, suggesting further upside movement over the next few sessions is probable.

The near term relative strength indicators, which had remained steady around mid range for the past couple of months, have begun to trend sharply higher and are not far from reaching overbought status - the only cautionary signal we have at this point and one that suggests a 'buy on the dips' strategy make work well here. Finally, the shorter term stochastics are rising very rapidly from extremely oversold levels, but have yet to reach mid range with plenty of upside before threatening an overbought condition. Remember though, the stochastics can move very, very rapidly - so a decent move up over the next couple of sessions could put these indicators well into overbought territory very soon. Still, we think this one's worth consideration, so we're making it our first spec play of the day (below) this morning.

Spec Plays:

VERT - Buy Range - $1.50 to $2.00 (risk to a break below the $1.30 area). Sell Range - $3.00 to $3.50. Previous close - $1.74.

1) vert

الشراء بين 1.50 الى2

الخطوره 1.30

البيع3 الى 3.50

السهم له تقرير مفصل وجميل ولكن اختصر في كلمتين

24 نوفمبر تمت مبايعة لاسهمها بسعر 1.10 الشركة نمت بشكل افضل من السنه المالية الماضيه وارباحها نمت بشكل جيد 3 مرات عن السنه الماضيه

والعملا ايضا 600%

الشراء واضح جدا من قبل المدراء والانسايدر السعر المتوقع والذي تصل له ان شاء الله خلال اسابيع قليلة 3 الى 3.5

الشركة تقدم حلول ادارية لكثير من الشركات 2000 شركة

يصف ان سعر السهم اصبح في السترونق هان اليد القويه وليس في اليد المتردده

وهذا تقريرvert

Stocks to watch:

VERT - it's hard to ignore the bullish near term technical signals now being exhibited by Verticalnet Inc (VERT). Shares of Verticalnet rose nearly 36% in an overwhelmingly negative market environment to close near their high of the session at $1.74 on very heavy trading volume (nearly 7 million shares traded hands versus the stock's 90 day average daily volume of just over 226k shares per day). No news out that we can see to affect such a change, so we have to assume it was purely technical in nature. Still, it was a very healthy technical development that from a chart price pattern perspective clearly signaled an upside breakout for a stock that was recovering from a 52 week low (set back in mid August) around the $1.00 area and one that was well off of its 52 week high it reached in late January of this year around the $3.70 area. If buying interest in this stock continues to mount, a return to the $3.00 to $3.50 area is quite possible over the next few weeks.

Verticalnet, Inc. is a provider of supply management solutions to Global 2000 companies. The Company provides supply management software, services and domain expertise in areas that include spend analysis, advanced esourcing, eprocurement, contract management and supplier scorecards. Its solutions are bundled into four process steps of supply management: Supply Strategy, Supply Selection, Supply Execution and Supply Performance. In addition, Verticalnet's professional services and consulting groups provide customers with project management, architecture and design, custom development services and training.

As most of you who've been with A-Z for some time may have figured out by now, we love to see major divergences in our technical analysis of a stock - and boy do we have a dilly with our technical assessment of VERT. Money flow into this stock is now at a nearly four year high. In fact, the last time accumulation in this stock was this high shares of Verticalnet were trading between $50 and $60 per share. This year alone as the stock continued to fall from its 52 week perch in the $3.70 area to near the $1.00 area over the first eight months of the year, money flow remained constant (after a limited drop from late January to early April after which it slowly began stairstepping higher once again). This suggests that the stock was moving from weak hands to strong hands. Yesterday's close of $1.74 put the stock's price well above the high end of our set Bollinger Band parameters, suggesting further upside movement over the next few sessions is probable.

The near term relative strength indicators, which had remained steady around mid range for the past couple of months, have begun to trend sharply higher and are not far from reaching overbought status - the only cautionary signal we have at this point and one that suggests a 'buy on the dips' strategy make work well here. Finally, the shorter term stochastics are rising very rapidly from extremely oversold levels, but have yet to reach mid range with plenty of upside before threatening an overbought condition. Remember though, the stochastics can move very, very rapidly - so a decent move up over the next couple of sessions could put these indicators well into overbought territory very soon. Still, we think this one's worth consideration, so we're making it our first spec play of the day (below) this morning.

Spec Plays:

VERT - Buy Range - $1.50 to $2.00 (risk to a break below the $1.30 area). Sell Range - $3.00 to $3.50. Previous close - $1.74.